Picture this: It’s Sunday afternoon, and the only thing standing between you and financial freedom is a couch and a Netflix binge. But what if there’s a better option? Making money while young isn’t just a dream: it’s a totally achievable goal. Whether it’s stacking cash for a future adventure or just wanting to afford that fancy coffee without checking your bank balance, the time to start building wealth is now. So, grab your favorite snack and settle in, because we’re diving into the world of opportunities waiting for you.

Table of Contents

ToggleUnderstanding Your Financial Goals

Setting Up the Right Mindset

Before diving headfirst into the sea of money-making strategies, one crucial step is understanding financial goals. Setting clear and achievable targets can make all the difference. Are you looking to save for college, buy a car, or maybe even fund a world trip? Knowing your ‘why’ gives purpose to your hustle.

A positive mindset is your best ally here. It’s about believing that financial freedom isn’t just for the fortunate few. With hard work and the right approach, you can be among them. Visualizing your goals can create motivation, making those late-night shifts or early-morning sessions worth every minute.

Identifying Opportunities for Income

Side Hustles and Freelancing

In today’s gig economy, opportunities abound. Side hustles have become a rite of passage for young people. Think of skills you already have – maybe you’re a whiz with graphic design or you have a knack for photography. Platforms like Fiverr and Upwork make it easy to showcase your talents and attract clients.

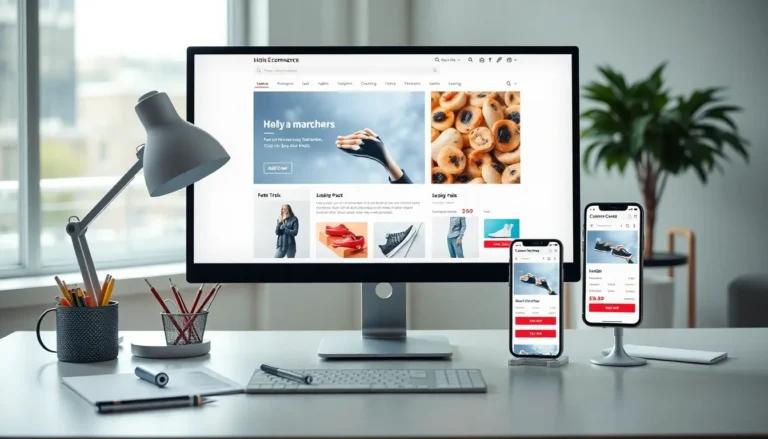

Online Opportunities and E-Commerce

E-commerce is a booming field, especially for young entrepreneurs. Starting an online store through platforms like Shopify or Etsy allows you to sell anything from handcrafted jewelry to digital products. Plus, the risk is relatively low, giving you room to experiment and learn as you go. Dropshipping is another attractive option, removing the need for inventory and allowing you to focus on marketing.

Investing at a Young Age

Understanding Basic Investment Options

Now that some cash is rolling in, the next step is investment. At a young age, there’s an incredible advantage: time. Compound interest is your best friend, and starting early means you’ll reap the rewards later.

Consider options like mutual funds, index funds, or even ETFs (Exchange-Traded Funds). They’re designed for beginners and can help you understand the market without overwhelming risk. Just remember, the goal isn’t to become a millionaire overnight: it’s about consistent growth over time.

Building a Diverse Portfolio

Networking and Learning From Others

Building a diverse investment portfolio isn’t just about picking random stocks. It’s about knowledge. Engaging in networking opportunities is pivotal. Attend local meetups, join online forums, or connect with people who have financial expertise. Learning from their successes and mistakes can provide invaluable insights.

Attend workshops and webinars, and never hesitate to ask questions. Educational resources are plentiful, and taking advantage of them could lead to groundbreaking opportunities.